Transfer of equity is a legal process for when you want to remove someone from or add someone to the title deeds of your property. In this blog, we’ll explore the reasons why you may want to transfer equity and the five key stages you need to consider.

The Reasons for Equity Transfer

One of the most common reasons for a transfer of equity is to remove a co-owner. This happens when a couple separates or gets divorced and you need to split any assets. The opposite happens when someone gets remarried or enters into a new partnership and they want to add someone to the deeds of the property.

Also, a more recent trend is to buy property with friends but if this situation no longer works for you, you may want to buy them out and own the property solely. Finally, if someone passes away, property is usually passed down to heirs through a will. The equity will then be transferred to the new owner.

The Five Key Stages in Transferring Equity

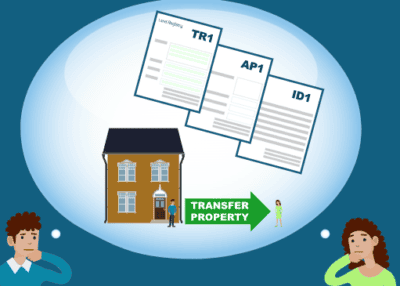

A solicitor or conveyancer can help with the transferring of equity and they will follow these 5 steps:

Check the Title Deeds – The solicitor will source a copy of the deeds of your home from the Land Registry ready for the equity transfer process.

Prepare the Documents – They will then prepare all the relevant documentation from the deeds. Always gain advice from a solicitor or conveyancer who can guide you through the legal process of transferring equity. Conveyancers such as https://www.samconveyancing.co.uk/news/conveyancing/transfer-of-equity-process-3894 can help with the transfer of equity process.

Set Up a Meeting with the Relevant Parties – Once the deed of transfer has been prepared by the solicitor, they will set up a meeting to sign the documents. This must be done in the presence of a witness.

Notify Your Mortgage Company – If the equity transfer involves taking out a new mortgage or remortgaging, you will need to get approval from a lender. They will assess your financial situation and the property to determine the terms of the new mortgage.

Transfer Ownership – The legal transfer of ownership will need to be registered with the Land Registry. This will involve signing the transfer deeds and it may involve a fee of somewhere between £50 and £920, depending on how much your property is worth.

You will also need to check whether there are any stamp duty implications when transferring equity, even if money is not changing hands. This is because the new joint owner is also taking on half the mortgage debt and if this goes above the stamp duty threshold, they will be liable.