The recent increases in interest rates have undoubtedly contributed to higher mortgage costs. As food prices continue to soar, along with energy prices, the cost of living crisis is at the forefront of everyone’s minds, especially homeowners. According to newly released figures, during October 2022, there was a very small increase in remortgage instructions and a significant increase in completed remortgages.

This increase in completions would appear to reflect widespread decisions by homeowners to secure product deals before any further rate rises resulted in lenders withdrawing products from the market.

For those would-be buyers who had not yet begun the remortgage process, there was a good deal of hesitancy evident, suggesting that they are waiting to see what the market does, specifically how property prices adjust and whether lender products return to the market.

As uncertainty in the property market looms, existing homeowners are also showing caution, choosing to seek better deals that offer long-term security. This is evidenced by remortgaging approvals (which only reflect remortgages with a new lender) which increased slightly to 51,300 in October, up from 49,500 in the previous month.

Many of those who are choosing to remortgage their properties are opting for a five year fixed rate product. This was by far the most popular remortgage option for transactions during October, confirming homeowners’ desire for stability in a volatile market.

Mixed Markets

In London and the South East, the average remortgage loan amount was significantly over £300,000 whilst average figures across the remainder of the UK sit at less than half of that. Properties in Ascot, for example, are amongst some of the most sought-after, with Ascot solicitors being in high demand.

According to Rightmove, In the last year alone, the majority of sales in Ascot were for detached properties, selling for an average price of £1,397,246. It is easy to understand why Ascot solicitors have been particularly busy, as homeowners are keen to remortgage, to access the best rates. Those considering remortgaging should always seek professional advice.

For homeowners lucky enough to be in a position to be able to afford to remortgage and find better deals, offering longer-term security, there was clearly considerable appetite to do so in October.

Uncertainty lies ahead

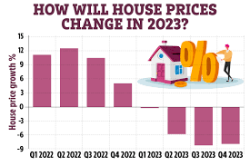

The industry, in general, is offering some words of caution as we head into 2023. There are suggestions that many would-be buyers and those planning remortgages are waiting to see whether rates fall in January. This approach comes with the inherent risk that rates could rise still further if economic conditions mandate this. There are absolutely no guarantees.

Many people are being faced with little choice but to remortgage to finance their way through the current crisis. Data shows a significant percentage of remortgages were for a higher loan value. Whilst some may be contemplating home improvements, many are likely to be simply freeing cash to help with the current challenges.

For those yet to move forward with new purchases or a remortgage, there is clearly an element of a gamble in the sense that rates could move in either direction in the new year.